Financial Prosperity Coaching: 7 Powerful Benefits in 2025

Why Financial Prosperity Coaching Is Changing How We Think About Money

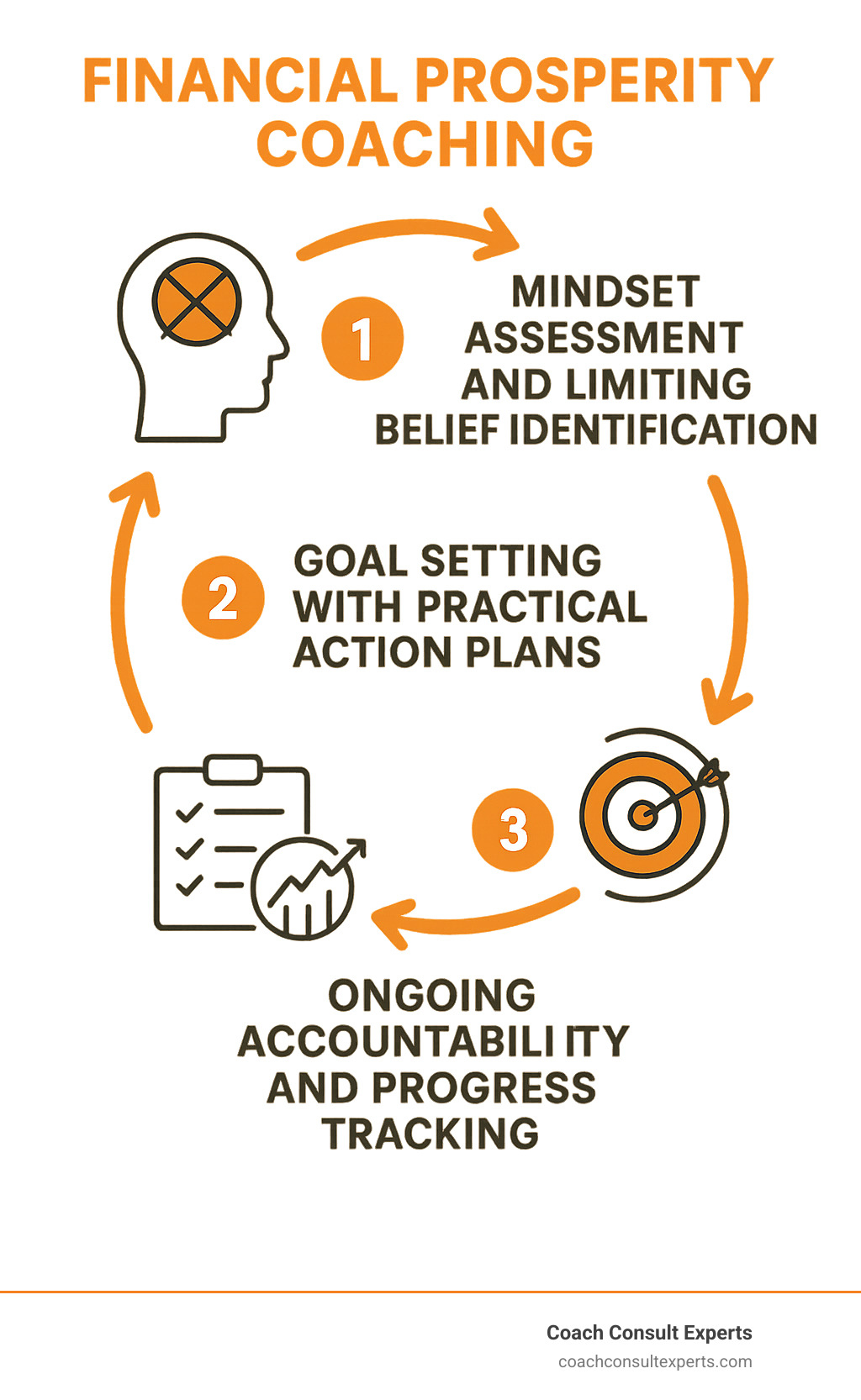

Financial prosperity coaching is a holistic approach that combines mindset change with practical money management to help individuals achieve lasting wealth and abundance. Unlike traditional financial advising, this coaching method addresses both the psychological barriers and tactical strategies needed for true financial freedom.

What Financial Prosperity Coaching Includes:

– Mindset work – Identifying and rewiring limiting beliefs about money

– Practical planning – Creating budgets, debt strategies, and investment plans

– Behavioral change – Building sustainable financial habits through accountability

– Goal setting – Establishing clear, measurable wealth-building objectives

– Ongoing support – Regular check-ins to maintain progress and momentum

The field has exploded as people recognize that financial success isn’t just about numbers – it’s about changing your relationship with money from the inside out. Research shows that coaching produces a 529% return on investment and significant benefits for both individuals and businesses.

I’m Coach Mary Chege-Kamau, a PCC-credentialed coach specializing in financial prosperity coaching who has helped thousands transform their money mindset and achieve outrageous success. My unique approach combines subconscious change techniques with practical wealth-building strategies to create lasting change.

What Is Financial Prosperity Coaching?

Financial prosperity coaching is like having a personal trainer for your money mindset and financial habits. It’s a specialized approach that combines the emotional and psychological work of life coaching with practical wealth-building strategies.

What makes this different from traditional financial advice? Financial prosperity coaching recognizes that your relationship with money runs much deeper than budgets and bank balances. Most money struggles stem from beliefs we picked up as kids – things like “money doesn’t grow on trees” or “we can’t afford that.”

The magic happens when coaches address both sides of the equation. They help you rewire limiting beliefs about money while creating concrete action plans for building real wealth. A prosperity coach becomes your partner in developing an abundance mindset and turning that new mindset into dollars in your bank account.

Financial Prosperity Coaching vs. Traditional Advising

| Financial Prosperity Coaching | Traditional Financial Advising |

|---|---|

| Focuses on mindset and behavior change | Primarily focuses on investment products |

| Commission-free, client-centered approach | Often commission-based recommendations |

| Addresses emotional money patterns | Limited emotional or psychological support |

| Emphasizes accountability and habit formation | Provides advice but limited follow-up |

| Holistic approach to all life areas | Narrow focus on investment portfolios |

| Teaches clients to be self-sufficient | Creates dependency on advisor expertise |

Traditional advisors excel at picking stocks and managing portfolios. But they rarely ask why you keep sabotaging your savings goals or why you feel guilty about spending money on yourself.

Financial prosperity coaching fills that gap. Your coach becomes your accountability partner who helps you understand the “why” behind your money decisions while helping you build the mental and emotional foundation for lasting wealth.

Core Pillars of Financial Prosperity Coaching

Every effective financial prosperity coaching program rests on five essential pillars:

Cash-flow clarity forms the foundation. You can’t improve what you don’t measure, so coaches help you get crystal clear on where your money comes from and where it goes.

Mindset rewiring is where the real change happens. Your coach helps you identify limiting beliefs that keep you stuck and choose new ones that support your financial goals.

Action plans turn insights into results. Your coach creates a personalized roadmap based on your unique situation and goals, including specific debt elimination strategies, automated savings systems, or income-boosting tactics.

Accountability check-ins keep you moving forward when motivation fades. Your coach celebrates your wins, helps you troubleshoot obstacles, and provides gentle nudges when you need them.

Measurable metrics ensure you can track your progress in concrete terms. You’ll monitor things like your net worth growth, debt reduction, savings rate, and mindset shifts through regular assessments.

How the Process Works: From First Call to Lasting Wealth

Starting your financial prosperity coaching journey begins with a “findy call” – a relaxed conversation where you and your potential coach figure out if you click. Think of this first chat as a friendly coffee date where you share your money story.

Once you decide to move forward together, your first real session dives deep. Your coach explores your current financial position and money history and patterns. The magic happens when you work together on values clarification – figuring out what truly matters to you beyond just having more money.

From there, you’ll set SMART goals that feel exciting rather than overwhelming. Your coach creates a personalized roadmap with bite-sized steps that won’t make you want to hide under the covers.

A Typical Session Breakdown

Every financial prosperity coaching session follows a rhythm that keeps you moving forward:

Your check-in gives you space to share what’s really going on. The wins review is where you get to celebrate – your coach will find victories you didn’t even notice.

Obstacle drilling is where the real breakthroughs happen. Your coach helps you untangle whatever got messy during the week, whether it’s a limiting belief or a practical strategy that needs tweaking.

During tool teaching, you learn something new every session. Your coach might introduce a budgeting method that works for your lifestyle, or teach you a mindset technique that stops money anxiety.

The session wraps up with next steps – specific actions you’ll take before you meet again. These aren’t random homework assignments but carefully chosen activities that move you closer to your goals.

Mindset & Behavior Change Tools

Financial prosperity coaching uses proven techniques to rewire how you think and feel about money:

Limiting belief reframes help you catch thoughts that sabotage your success. Somatic practices recognize that money stress lives in your body, not just your mind. Many coaches integrate law of attraction principles to help align your thoughts with your financial goals.

Automatic saving systems make good financial behavior effortless. Habit stacking links new financial behaviors to things you already do.

For those ready to dive deeper into abundance work, our Four Steps to Activating Your Abundance guide provides a comprehensive framework.

Methodologies & Frameworks

Professional coaches use proven systems like the MAPS model that combines Mindset work with Action planning, Practical strategies, and Systematic implementation.

The Rainmaker Process helps clients convert their skills into sustainable income streams. Some coaches use Enneagram money styles to understand how your core personality drives your financial behaviors.

Advanced coaches employ subconscious change techniques to address deep-seated money blocks, creating breakthrough moments that accelerate your entire journey.

Benefits, Outcomes & Success Metrics

When you invest in financial prosperity coaching, you get life-changing results that compound over time. The numbers speak for themselves: coaching delivers an impressive 529% return on investment according to FM Magazine.

Clients see dramatic financial improvements like doubled client bases, movement from paycheck-to-paycheck stress to retirement planning confidence, and significant jumps in net worth and credit scores. Business owners often quadruple their recurring revenue while employees find new earning capacity.

The real magic happens in how people feel about money. Clients finally have clarity and control over their finances instead of constant anxiety. They shift from thinking “there’s never enough” to seeing opportunities everywhere.

How Clients Measure Success

Success in financial prosperity coaching involves tracking real, measurable progress:

The financial metrics include net worth growth tracked monthly or quarterly, debt-to-income ratio improvements, and increased savings rate. Building that emergency fund often becomes a game-changer, while investment portfolio performance shows long-term wealth building.

We also use mindset surveys to track belief evolution and lifestyle fulfillment diaries to see how spending aligns with values. We monitor stress levels around financial topics and improvements in money-related communication with partners.

Common Challenges & Solutions

Scarcity thinking might be the biggest roadblock – when you believe there’s never enough money, every decision comes from fear. We address this through abundance mindset training and evidence-gathering exercises.

Chronic overspending isn’t solved with more willpower – it requires understanding emotional spending triggers and creating systems that work with your psychology. We do deep values clarification work and set up automatic systems.

Inconsistent income requires different strategies than traditional budgeting. We focus on creating multiple income streams and building larger emergency funds.

The biggest challenge might be accountability gaps – knowing what to do but struggling to do it consistently. This is where coaching really shines through regular check-ins and progress tracking systems.

Research from the International Coaching Federation consistently shows that professional coaching relationships produce significant ROI and lasting personal change.

Becoming a Financial Prosperity Coach: Qualifications, Skills, Career Tips

If you’ve dreamed of helping others break free from financial stress while building a meaningful career, financial prosperity coaching might be your calling. The field offers incredible opportunities, and specializing in financial prosperity coaching can dramatically improve your success odds.

Most prosperity coaches charge between $100 and $200 per hour for their services, with experienced coaches often commanding higher rates.

Required Credentials & Training

Your coaching journey typically starts with life coach certification from an ICF-accredited program. This is where you’ll learn essential skills like active listening, powerful questioning, and ethical guidelines.

Financial education comes next through formal degrees or targeted continuing education programs. Specialized prosperity training combines practical financial knowledge with mindset change techniques.

Advanced credentials like CFP® can add credibility but aren’t necessary for everyone. Practicum hours are invaluable for building confidence and refining skills.

Essential Skills for Success

Successful financial prosperity coaches need a unique blend of heart and head:

Building genuine relationships is crucial because money is such a vulnerable topic. Empathy and compassion help you understand clients’ emotional money experiences. Active listening means hearing what clients don’t say about their financial fears.

On the technical side, financial literacy is non-negotiable. You need to understand budgeting, investing, debt management, and wealth-building principles. Goal setting methodology and understanding behavioral change science give you tools for lasting client change.

Don’t forget business skills: Digital marketing helps build your online presence, sales conversation skills allow authentic client enrollment, and group facilitation opens additional revenue streams.

Income Potential & Business Models

Individual hourly coaching is where most coaches start at $100-$200 per hour. Package programs are where real money lives – comprehensive 3-6 month programs ranging from $1,500 to $10,000 or more.

Group coaching programs let you serve more people while maintaining high value. Passive income products like courses and books generate “mailbox money.” Corporate contracts offer steady retainer income through employee financial wellness programs.

Pro Tips from Experienced Coaches

Engage in deep conversations rather than surface-level networking. Ask for referrals strategically during breakthrough moments. Accept “coopetition” – collaborate with other coaches instead of viewing them as competition.

Invest in continuous learning because successful coaches never stop growing.

For coaches ready to take their practice to the next level, our DreamBuilder Program Spring 2024 offers advanced training in rapid change techniques and business development strategies.

Cost, Choosing the Right Coach & Real-Life Success Stories

How Much Does Financial Prosperity Coaching Cost?

Financial prosperity coaching costs vary significantly based on experience and service model:

Hourly Rates

– New coaches: $75-$125 per hour

– Experienced coaches: $150-$250 per hour

– Master coaches: $300+ per hour

Package Programs

– 3-month programs: $1,500-$5,000

– 6-month programs: $3,000-$10,000

– Year-long programs: $5,000-$25,000+

Group Coaching

– 6-week programs: $500-$1,500

– 12-week intensives: $1,000-$3,000

– Mastermind programs: $2,000-$10,000+

Many coaches offer income-based pricing to make coaching accessible. When evaluating cost, consider the documented 529% return on investment that coaching provides.

Selecting the Right Coach

Choosing the right coach is crucial for success:

Check Credentials – Look for ICF certification, relevant financial education, specialized prosperity training, and positive testimonials.

Assess Methodology Fit – Different coaches use different approaches. Ensure their methodology resonates with your learning style.

Evaluate Personality Match – You need to feel comfortable sharing intimate financial details. Trust your instincts about personality fit.

Take Advantage of Free Consultations – Most professional coaches offer complimentary findy calls to assess mutual fit.

For group coaching options, our Group Coaching Programs provide community support at accessible prices.

Success Stories

Real client changes demonstrate the power of financial prosperity coaching:

The Seven-Figure Business Owner – A struggling entrepreneur overcame limiting beliefs about premium pricing and grew from six to seven figures within 18 months.

From Paycheck-to-Paycheck to Investor – A couple eliminated $30,000 in debt and began investing for retirement within two years through expense tracking and abundance mindset work.

The Anxiety-to-Abundance Change – A real estate professional eliminated weekend anxiety attacks and saw measurable revenue increases through family-of-origin money pattern work.

Frequently Asked Questions about Financial Prosperity Coaching

What makes financial prosperity coaching different from money management apps?

While money management apps track spending and organize financial data, financial prosperity coaching digs into the human side of money that no app can touch.

An app can tell you that you spent $200 on coffee last month, but it can’t help you understand why you keep buying expensive lattes when stressed about debt. It can’t help you work through the limiting belief that “I’ll never be good with money.”

Financial prosperity coaching addresses the emotional and psychological patterns that drive your financial decisions. Coaches help you understand the connection between childhood money experiences, current beliefs, and spending habits. They provide human insight, empathy, and personalized guidance that technology cannot offer.

The real magic happens when you combine both – using apps for tracking while working with a coach for mindset shifts and behavioral changes that create lasting financial change.

Can coaching help if I’m already financially stable?

Absolutely! Many successful clients come to financial prosperity coaching not because they’re struggling, but to optimize what’s already working.

Financial stability is the perfect foundation for accelerating wealth-building. When you’re not in survival mode, you can focus on bigger goals like building multiple income streams, creating passive income, or preparing for early retirement.

Even successful people often carry lingering money anxiety or limiting beliefs that cap their potential. Financial prosperity coaching helps identify and clear these subtle blocks that keep you from your next level.

How long before I see tangible results?

Within the first few weeks, most clients experience the “clarity breakthrough” – your financial picture makes sense and overwhelm starts lifting.

In the first month or two, concrete behavioral changes take root. You might find yourself naturally making better spending decisions or consistently tracking expenses.

Around the three-month mark, deeper mindset shifts show up in your bank account. Clients often report increased income opportunities, successful debt reduction, or hitting savings milestones.

By six months and beyond, most clients have completely transformed their relationship with money, replacing stress and scarcity thinking with confidence and abundance mindset.

Conclusion & Next Steps

Your journey with financial prosperity coaching doesn’t have to remain a distant dream. The evidence is overwhelming – this approach works because it tackles money challenges from every angle, combining the practical with the psychological to create real, lasting change.

Traditional financial advice tells you what to do, but financial prosperity coaching helps you understand why you’re not doing it and how to make it stick. That’s the difference between temporary fixes and lifetime change.

At Coach Consult Experts, we’ve seen this change happen countless times. Our clients don’t just improve their bank balances – they completely transform their relationship with money. They move from anxiety to confidence, from scarcity to abundance, from surviving to thriving.

What makes our approach different? We specialize in rapid subconscious change techniques that get to the root of money blocks quickly. We also believe in the power of community through our group coaching programs that create supportive environments.

The numbers don’t lie. Research consistently shows that coaching produces a 529% return on investment. But beyond statistics, what matters most is how you’ll feel when you finally have control over your finances.

Your next step is simple. Stop letting fear, confusion, or past failures keep you stuck in financial mediocrity. You deserve prosperity, and it’s absolutely achievable for you.

Every day you wait is another day of staying where you are. But every day you take action is a day closer to the financial freedom you want.

Ready to experience the rapid change that our clients rave about? Our VIP Coaching program combines intensive one-on-one sessions with our proven group support system. This isn’t just coaching – it’s a complete change experience designed to fast-track your journey to financial prosperity.

Your abundant future is waiting. The only question left is whether you’re ready to claim it. Take that first step today – your future self will thank you.